Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENTSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | |||

Filed by a Party other than the Registranto | |||

Check the appropriate box: | |||

o | Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

ý | Definitive Proxy Statement | ||

o | Definitive Additional Materials | ||

o | Soliciting Material Pursuant to §240.14a-12 | ||

CARLISLE COMPANIES INCORPORATED | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

CARLISLE COMPANIES INCORPORATED

1160516430 North Community HouseScottsdale Road, Suite 600400Charlotte, North Carolina 28277Scottsdale, Arizona 85254(704) 501-1100(480) 781-5000

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERSSTOCKHOLDERS

The 20152018 Annual Meeting of ShareholdersStockholders (the "Annual Meeting") of Carlisle Companies Incorporated (the "Company") will be held in the Niagara meeting room of the Hilton Garden Inn Toledo Perrysburg located at 6165 Levis Commons Blvd.8:00 a.m., Perrysburg, Ohio 43551Eastern Time, on Wednesday, May 6, 2015,2, 2018 at 12:00 noon eastern timethe offices of Accella Performance Materials located at 100 Enterprise Drive, Cartersville, Georgia 30120, for the following purposes:

The Board of Directors unanimously recommends that you vote "FOR" items 1, 2 and 3. The proxy holders will use their discretion to vote on other matters that may properly arise at the Annual Meeting or any adjournment or postponement thereof.

Only shareholdersstockholders of record atas of the close of business on March 11, 20157, 2018 will be entitled to vote at the Annual Meeting whether or not they have transferred their stock since that date.

YOUR VOTE IS IMPORTANT

If you own your shares directly as a registered shareholderstockholder or through the Company'sCarlisle, LLC Employee Incentive Savings Plan, please vote in one of these ways:

If you own your shares indirectly through a bank, broker or broker, you may vote in accordance withsimilar organization, please follow the instructions provided by your bank or broker. Those instructions may include online voting. If you receive or request a voting instruction form from the holder of record to vote your bank or broker, you may also return the completed form by mail or vote by telephone if a number is provided. You may also obtain a legal proxy from your bank or broker and submit a ballot in person at the 2015 Annual Meeting of Shareholders.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2015 ANNUAL MEETING OF SHAREHOLDERS OF THE COMPANY TO BE HELD ON MAY 6, 2015:

The proxy materials relating to the 2015 Annual Meeting, including the form of proxy card, the 2014 Annual Report and the Form 10-K are available on the Internet. Please go to www.proxyvote.com to view and obtain the proxy materials online.shares.

| By Order of the Board of Directors, | ||

Robert M. Roche Vice President and Chief Financial Officer |

Charlotte, North CarolinaScottsdale, Arizona

March 20, 201519, 2018

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders To Be Held on May 2, 2018:

The Notice of 2018 Annual Meeting of Stockholders, Proxy Statement and

2017 Annual Report to Stockholders are available atwww.proxyvote.com.

i

This Proxy Statement is being furnished in connection with the solicitation by the Board of Directors (the "Board of Directors" or the "Board") of Carlisle Companies Incorporated (the "Company") of proxies to be voted at the 20152018 Annual Meeting of Shareholders toStockholders (the "Annual Meeting"). The Annual Meeting will be held in the Niagara meeting room of the Hilton Garden Inn Toledo Perrysburg located at 6165 Levis Commons Blvd.8:00 a.m., Perrysburg, Ohio 43551Eastern Time, on Wednesday, May 6, 2015,2, 2018 at 12:00 noon eastern time.the offices of Accella Performance Materials located at 100 Enterprise Drive, Cartersville, Georgia 30120.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the "SEC rules"), instead of mailing a printed copy of the proxy materials to each shareholderstockholder of record, the Company is furnishing proxy materials to its shareholdersstockholders via the Internet. You will not receive a printed copy of the proxy materials unless you request a copy. Instead, the Notice of Internet Availability of Proxy Materials instructs you how to access and review the proxy materials over the Internet. If you would like to receive a printed copy of the proxy materials, you should follow the instructions for requesting those materials included in the Notice.notice.

The Notice of Internet Availability of Proxy Materials, is first being sent to shareholders on or about March 20, 2015. Thisa printed copy of the proxy materials (including this Proxy Statement and the form of proxy card relatingproxy), as applicable, was sent to the 2015 Annual Meeting are also first being made available to shareholders on or aboutstockholders beginning March 20, 2015.19, 2018.

The Proxyproxy is solicited by the Board of Directors of the Company. The cost of proxy solicitation will be borne by the Company. In addition to the solicitation of proxies by use ofmail and the Internet, officers and regular employees of the Company may devote part of their time to solicitation by correspondence sent via e-mail, facsimile or regular mail and telephone or personal calls. Arrangements may also be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to beneficial owners and for reimbursement of their out-of-pocket and clerical expenses incurred in connection therewith. Proxies may be revoked at any time prior to voting.the taking of the vote at the Annual Meeting. See "Voting by Proxy and Confirmation of Beneficial Ownership" beginning on page 52.50.

The mailing address of the Company's principal executive offices of the Company is Carlisle Companies Incorporated, 1160516430 North Community HouseScottsdale Road, Suite 600, Charlotte, North Carolina 28277. 400, Scottsdale, Arizona 85254.Upon written request mailed to the attention of the Secretary of the Company, at the Company's principal executive offices, the Company will provide without charge a copy of its 2014 Annual Report on Form 10-K for the fiscal year ended December 31, 2017 filed with the Securities and Exchange Commission.Commission (the "SEC").

The record date for the Annual Meeting is March 7, 2018. Only holders of record of the Company's common stock ("Shares" or "Common Shares") as of the close of business on that date will be entitled to vote at the Annual Meeting. As of the record date, 61,372,778 Shares were outstanding. The presence, in person or by proxy, of the ownersholders of a majority of the votes entitled to be cast is necessary forto constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and Shares owned through a broker that are voted on any matter are included in determining the number of votes present or represented at the meeting. Shares owned through a broker that are not voted on any matter at the meeting are not included in determining whether a quorum is present.

Under New York Stock Exchange rules, the proposals to approve an amendment to the Company's Restated Certificate of Incorporation to increase the number of authorized shares of common stock and to ratify the appointment of the independent registered public accounting firm are considered "discretionary" proposals. This means that brokerage firms may vote in their discretion on the proposals on behalf of clients who have not furnished express voting instructions. The proposal to elect the three directors nominated by the Board, the advisory vote to approve the Company's executive compensation and the proposal to approve the Company's amended and restated Incentive Compensation Program to increase the number of shares available for issuance thereunder are "non-discretionary" proposals, which means that brokerage firms may not use their discretion to vote on any of these matters unless they receive express voting instructions from their clients as described below.

Voting Methods

If your shares are registered directly in your name with the Company's transfer agent, Computershare Investor Services, LLC, you are considered the registered holder of those shares. As the registered shareholder, you can ensure your shares are voted at the 2015 Annual Meeting by submitting your instructions (i) over the Internet, (ii) by mail (only if you received or request a proxy card) by completing, signing, dating and returning the proxy card in the envelope provided, (iii) by telephone (only if you received or request a proxy card) by calling the phone number on the proxy card, or (iv) by attending the 2015 Annual Meeting and voting your shares at the meeting. Telephone and Internet voting for registered shareholders will be available 24 hours a day, up until 11:59 pm Eastern time on May 5, 2015. You may obtain directions to the 2015 Annual Meeting in order to vote in person by visiting the Company's website at www.carlisle.com/2015proxymaterials.

Most Company shareholders hold their shares through a broker, bank, trustee or another nominee, rather than directly in their name. In that case, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank, trustee or nominee, together with a voting instruction card. As the beneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which the beneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction cards.

If you participate in the Carlisle Corporation Employee Incentive Savings Plan (the "401(k) Plan") and own Company shares through your 401(k) Plan account, Wells Fargo Bank, N.A. ("Wells Fargo"), the trustee of the 401(k) Plan, will vote your 401(k) Plan shares in accordance with the instructions you provide by voting online, by telephone or on the voting instruction card. If Wells Fargo does not receive voting instructions from you by 11:59 pm Eastern time on May 5, 2015, Wells Fargo will vote your 401(k) Plan shares as directed by the Carlisle Pension and Insurance Committee (the 401(k) Plan administrator) in its discretion.

Votes Required for Approval of Proposals

The following are the voting requirements for each proposal:

Proposal One, Election of Directors. For the election of directors, the three nominees receiving the highest number of all votes cast for directors at the annual meeting will be elected as directors.

Proposal Two, Advisory Vote to Approve the Company's Executive Compensation. This is an advisory vote the result of which is non-binding. However, the Board will consider the outcome of the vote when making future executive compensation decisions.

Proposal Three, Ratification of Appointment of Independent Registered Public Accounting Firm. Approval of the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for fiscal year 2015 requires the affirmative vote of a majority of the total votes of all common shares present in person or represented by proxy and entitled to vote on the proposal at the annual meeting.

Proposal Four, Approval of an Amendment to the Company's Restated Certificate of Incorporation. Approval of the amendment to the Company's Restated Certificate of Incorporation requires the affirmative vote of a majority of the outstanding shares of Company common stock entitled to vote on the proposal at the annual meeting.

Proposal Five, Approval of the Company's amended and restated Incentive Compensation Plan. Approval of the Company's amended and restated Incentive Compensation Plan requires the affirmative vote of a majority of the total votes of all common shares present in person or represented by proxy and entitled to vote on the proposal at the annual meeting.

Other Business. For any other matters, the affirmative vote of a majority of the total votes of all shares of common stock present in person or represented by proxy and entitled to vote on the item at the annual meeting will be required for approval.

With respect to Proposal One, the election of directors, withhold votes, broker non-votes (if any) and abstentions will have no effect on the outcome of the proposal.

With respect to Proposals Two, Three and Five, the advisory vote to approve the Company's executive compensation, ratification of the appointment of the Independent Registered Public Accounting Firm and approval of the Company's amended and restated Incentive Compensation Plan, an abstention will be counted as a vote present and entitled to vote on the proposals and will have the same effect as a vote against the proposals, and a broker non-vote will not be considered entitled to vote on these proposals and will therefore have no effect on their outcome.

With respect to Proposal Four, approval of an amendment to the Company's Restated Certificate of Incorporation, abstentions and broker non-votes (if any) will have the same effect as a vote against the proposal.

VOTING SECURITIES Voting Rights and Procedures

At the close of business on March 11, 2015, the Company had 65,159,025 shares of common stock ("Shares" or "Common Shares") outstanding, all of which are entitled to vote. The Company's Restated Certificate of Incorporation provides that each person who received Shares pursuant to the Agreement of Merger, dated March 7, 1986, which was approved by the shareholdersstockholders of Carlisle Corporation and became effective on May 30, 1986, is entitled to five votes per Share. Persons acquiring Shares after May 30, 1986 (the effective date of the Merger)merger) are entitled to one vote per Share until the Shares have been beneficially owned (as defined in the Restated Certificate of Incorporation) for a continuous period of four years. Following continuous ownership for a period of four years, the

Shares are entitled to five votes per Share. The actual voting power of each holder of Shares will be based on shareholderstockholder records at the time of the Annual Meeting. See "Voting by Proxy and Confirmation of Beneficial Ownership" beginning on page 52.50. In addition, holders of Shares issued from the treasury, other than in connection with the exercise of stock options, before the close of business on March 11, 20157, 2018 (the record date for determining shareholdersstockholders entitled to vote at the Annual Meeting) will be entitled to five votes per Share unless the Board of Directors determines otherwise at the time of authorizing such issuance.

If your Shares are registered directly in your name with the Company's transfer agent, Computershare Investor Services, LLC, you are considered the registered holder of those Shares. As the registered stockholder, you can ensure your Shares are voted at the Annual Meeting by submitting your instructions (i) via the Internet, (ii) by mail (only if you received or request a proxy card) by completing, signing, dating and promptly returning the proxy card in the envelope provided, (iii) by telephone (only if you received or request a proxy card) by calling the phone number on the proxy card or (iv) by attending the Annual Meeting and voting your Shares at the meeting. Telephone and Internet voting for registered stockholders will be available 24 hours a day, up until 11:59 p.m., Eastern Time, on May 1, 2018. You may obtain directions to the Annual Meeting in order to vote in person by calling the Company's principal executive offices at (480) 781-5000.

Most Company stockholders hold their Shares through a bank, broker or other nominee, rather than directly in their name. In that case, you are considered the beneficial owner of Shares held in street name, and the proxy materials are being forwarded to you by your bank, broker or other nominee, together with a voting instruction form. As the beneficial owner, you are entitled to direct the voting of your Shares by your intermediary. Brokers, banks and other nominees typically offer telephonic or electronic means by which the beneficial owners of Shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction forms.

If you participate in the Carlisle, LLC Employee Incentive Savings Plan (the "401(k) Plan") and own Shares through your 401(k) Plan account, Wells Fargo Bank, N.A. ("Wells Fargo"), the trustee of the 401(k) Plan, will vote your 401(k) Plan Shares in accordance with the instructions you provide by voting via the Internet, by telephone or on the voting instruction form. If Wells Fargo does not receive voting instructions from you by 11:59 p.m., Eastern Time, on May 1, 2018, Wells Fargo will vote your 401(k) Plan Shares as directed by the Carlisle Pension and Insurance Committee, the 401(k) Plan administrator, in its discretion.

Votes Required to Approve Each of the Proposals

The following are the voting requirements to approve each of the proposals:

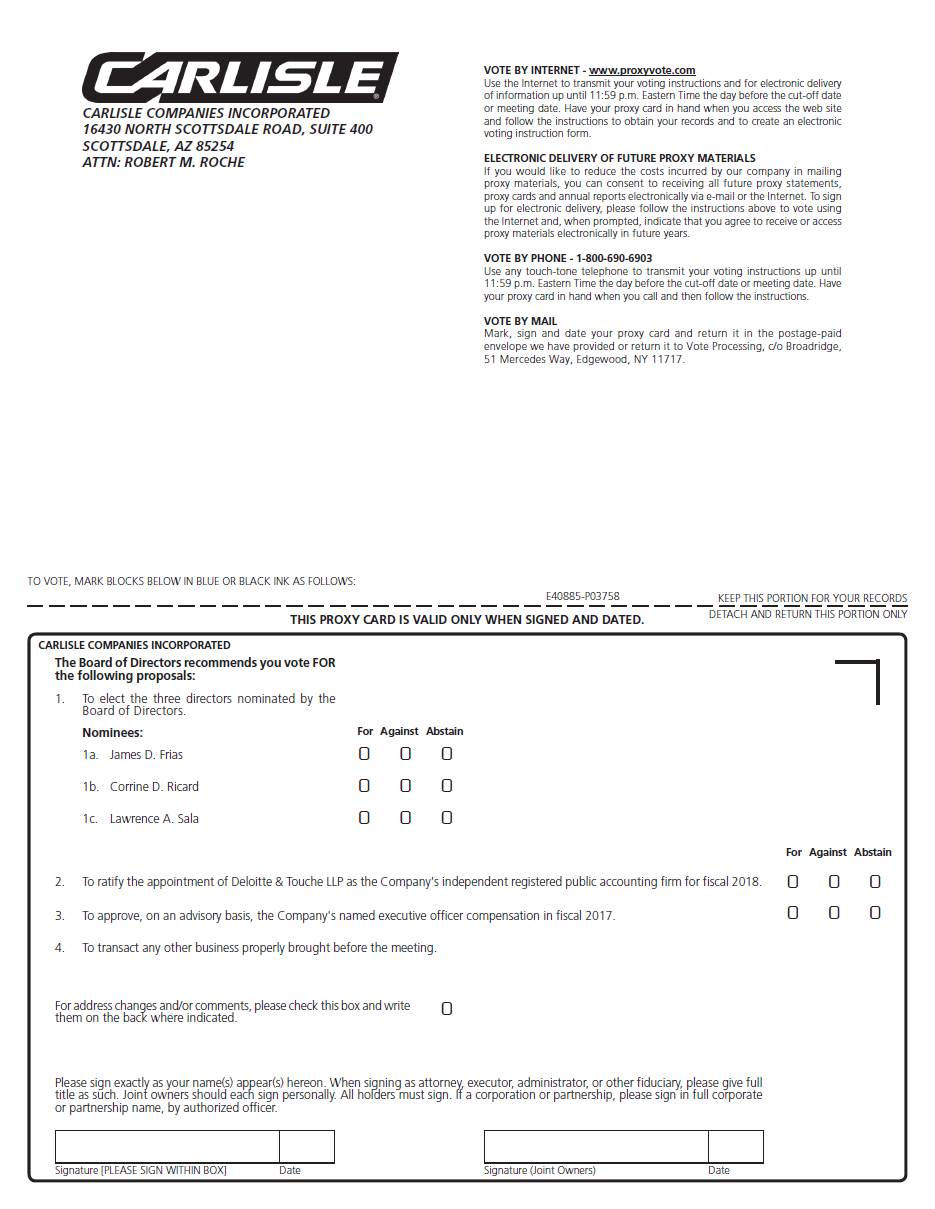

Proposal 1, Election of Directors. Directors shall be elected by the affirmative vote of a majority of the votes cast (meaning that the number of votes cast "for" a nominee must exceed the number of votes cast "against" such nominee). If an incumbent director does not receive a majority of the votes cast, the director must promptly tender his or her offer of resignation to the Board for consideration.

Proposal 2, Ratification of the Appointment of Independent Registered Public Accounting Firm. Ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for fiscal 2018 requires the affirmative vote of a majority of the total votes of all Shares present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting (meaning that of the total votes of all Shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted "for" the proposal for it to be approved).

Proposal 3, Advisory Vote to Approve Named Executive Officer Compensation. Advisory approval of the Company's named executive officer compensation in fiscal 2017 requires the affirmative vote of a majority of the total votes of all Shares present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting (meaning that of the total votes of all Shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted "for" the proposal for it to be approved).

Other Items. Approval of any other matters requires the affirmative vote of a majority of the total votes of all Shares present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting (meaning that of the total votes of all Shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted "for" the proposal for it to be approved).

Effect of Abstentions and Broker Non-Votes

Abstentions and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum for the Annual Meeting. A broker non-vote occurs when a nominee holding Shares in street name for a beneficial owner votes on one proposal but does not vote on another proposal because, with respect to such other proposal, the nominee does not have discretionary voting power and has not received voting instructions from the beneficial owner.

Under New York Stock Exchange rules and regulations (the "NYSE rules"), Proposal 2, the ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for fiscal 2018, is considered a "routine" matter, which means that brokerage firms may vote in their discretion on this proposal on behalf of clients who have not furnished voting instructions. However, Proposals 1 and 3, the election of directors and the advisory vote to approve the Company's named executive officer compensation in fiscal 2017, respectively, are "non-routine" matters under the NYSE rules, which means that brokerage firms that have not received voting instructions from their clients on these matters may not vote on these proposals.

With respect to Proposal 1, the election of directors, you may vote "for" or "against" each of the nominees for the Board, or you may "abstain" from voting for one or more nominees. If you "abstain" from voting with respect to one or more director nominees, your vote will have no effect on the election of such nominees. Broker non-votes will also have no effect on the election of the nominees.

With respect to Proposals 2 and 3, the ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for fiscal 2018 and the advisory vote to approve the Company's named executive officer compensation in fiscal 2017, respectively, you may vote "for" or "against" the proposals, or you may "abstain" from voting on the proposals. An abstention will be counted as a vote present or represented and entitled to vote on the proposals and will have the same effect as a vote "against" the proposals, and a broker non-vote will not be considered entitled to vote on these proposals and will therefore have no effect on their outcome. As discussed above, because Proposal 2, the ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for fiscal 2018, is considered a "routine" matter, we do not expect any broker non-votes with respect to this proposal.

A. Certain Beneficial Owners.Owners

The following table below provides certain information about the beneficial ownership of Common Shares as of December 31, 2014 with respect to any2017 by each person who is known toby the Company to have been the beneficial owner ofbeneficially own more than five percent (5%)5% of the outstanding Common Shares the Company's only classas of voting securities.such date. As defined in Securities and Exchange Commission Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), "beneficial ownership" means essentially that a person has or shares voting or investment decision power over shares. It does not necessarily mean that the person enjoyed any economic benefit from those shares. The information included in the table is from Schedules 13G filed with the Securities and Exchange Commission by (i) JPMorgan Chase & Co., (ii) The Vanguard Group, Inc., (iii) Capital Research Global Investors and (iv) BlackRock Inc.

Name and Address of Beneficial Owner | Number of Shares(1) | Percentage(2) | |||||

|---|---|---|---|---|---|---|---|

JPMorgan Chase & Co. | |||||||

270 Park Avenue | |||||||

New York, New York 10017 | 7,360,492 | 11.4 | % | ||||

The Vanguard Group, Inc. | |||||||

100 Vanguard Boulevard | |||||||

Malvern, Pennsylvania 19355 | 4,432,942 | 6.9 | % | ||||

Capital Research Global Investors | |||||||

333 South Hope Street | |||||||

Los Angeles, California 90071 | 4,325,214 | 6.7 | % | ||||

BlackRock Inc. | |||||||

55 East 52nd Street | |||||||

New York, NY 10022 | 4,044,189 | 6.3 | % | ||||

Name and Address of Beneficial Owner | Number of Shares and Nature of Beneficial Ownership | Percent of Class | |||||

|---|---|---|---|---|---|---|---|

The Vanguard Group, Inc. | |||||||

100 Vanguard Boulevard | |||||||

Malvern, Pennsylvania 19355 | 5,843,193 | (1) | 9.4 | % | |||

BlackRock Inc. | |||||||

55 East 52nd Street | |||||||

New York, New York 10055 | 5,069,351 | (2) | 8.2 | % | |||

JPMorgan Chase & Co. | |||||||

270 Park Avenue | |||||||

New York, New York 10017 | 3,797,916 | (3) | 6.1 | % | |||

Eaton Vance Management | |||||||

2 International Place | |||||||

Boston, Massachusetts 02110 | 3,157,158 | (4) | 5.1 | % | |||

B. Nominees, Directors and Officers.Management

The following table provides information as of February 27, 2015, as reported to the Company by the persons and members of the group listed, as toshows the number and the percentage of Common Shares beneficially owned by: (i)as of February 28, 2018 by each director, nominee andfor director, named executive officer named in the Summaryand all directors and

Compensation Table on page 31; and (ii) all directors and current of Contents

executive officers of the Company as a group. As of February 28, 2018, a total of 61,501,038 Common Shares were outstanding.

Name of Director/Executive | Shares Owned | Shares Subject to Options | Share Equivalent Units(a) | Total Beneficial Ownership | Percent of Class | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name | Shares Owned | Shares Subject to Options | Share Equivalent Units(1) | Total Beneficial Ownership | Percent of Class | |||||||||||||||||||||||||||

Robin J. Adams | 5,609 | — | 11,603 | 17,212 | 0.03 | % | 5,959 | — | 15,951 | 21,910 | * | |||||||||||||||||||||

Robert G. Bohn | 7,131 | — | 15,488 | 22,619 | 0.03 | % | 7,655 | — | 19,987 | 27,642 | * | |||||||||||||||||||||

Robin S. Callahan | 26,307 | (b) | — | 15,627 | 41,934 | 0.06 | % | |||||||||||||||||||||||||

James. D. Frias | — | — | 1,839 | 1,839 | 0.01 | % | ||||||||||||||||||||||||||

Jonathan R. Collins | — | — | 3,328 | 3,328 | * | |||||||||||||||||||||||||||

James D. Frias | 350 | — | 5,809 | 6,159 | * | |||||||||||||||||||||||||||

Terry D. Growcock | 3,027 | — | 15,983 | 19,010 | 0.03 | % | 991 | — | 20,501 | 21,492 | * | |||||||||||||||||||||

Stephen P. Munn | 353,033 | (c) | — | — | 353,033 | 0.53 | % | |||||||||||||||||||||||||

D. Christian Koch | 113,649 | (2)(3)(4) | 129,826 | 692 | 244,167 | * | ||||||||||||||||||||||||||

Gregg A. Ostrander | 4,066 | — | 21,806 | 25,872 | 0.04 | % | 4,459 | — | 28,212 | 32,671 | * | |||||||||||||||||||||

Corrine D. Ricard | — | — | 4,409 | 4,409 | * | |||||||||||||||||||||||||||

David A. Roberts | 240,000 | (d)(e)(f) | 538,090 | 55,680 | 833,770 | 1.26 | % | 242,107 | (2) | 36,533 | 4,188 | 282,828 | * | |||||||||||||||||||

Lawrence A. Sala | 18,248 | 8,000 | 24,556 | 50,804 | 0.08 | % | 18,248 | — | 29,406 | 47,654 | * | |||||||||||||||||||||

Magalen C. Webert | 72,587 | (g) | 8,000 | 27,797 | 108,384 | 0.16 | % | |||||||||||||||||||||||||

Jesse G. Singh | — | — | 1,643 | 1,643 | * | |||||||||||||||||||||||||||

John W. Altmeyer | 96,646 | (d)(e)(f) | 206,243 | 71,564 | 374,453 | 0.57 | % | 89,466 | (2)(3)(4) | 72,685 | 106,775 | 268,926 | * | |||||||||||||||||||

John E. Berlin | 53,621 | (d)(e)(f) | 27,872 | 1,000 | 82,493 | 0.12 | % | 28,907 | (2)(3)(4) | 27,865 | 1,000 | 57,772 | * | |||||||||||||||||||

Steven J. Ford | 57,987 | (d)(e)(f) | 131,513 | 39,962 | 229,462 | 0.35 | % | 59,636 | (2)(3)(4) | 82,401 | 61,562 | 203,599 | * | |||||||||||||||||||

D. Christian Koch | 62,996 | (d)(e)(f) | 79,868 | 716 | 143,580 | 0.22 | % | |||||||||||||||||||||||||

16 directors and executive officers as a group | 2,428,896 | 3.68 | % | |||||||||||||||||||||||||||||

Robert M. Roche | 10,787 | (3)(4) | 4,043 | 3,571 | 18,401 | * | ||||||||||||||||||||||||||

Directors and executive officers as a group (23 persons) | 1,484,583 | (4) | 2.4 | % | ||||||||||||||||||||||||||||

PROPOSAL ONE:1:

ELECTION OF DIRECTORS

The number of directors is currently fixed at 11. The Company's Restated Certificate of Incorporation provides for a classified Board of Directors under which the Board is divided into three (3) classes of directors, with each class as nearly equal in number as possible.

Three directors are to be elected at the 2015 Annual Meeting. Each directorIf elected, each nominee will be elected to serve for a three-year term untilexpiring at the 20182021 Annual Meeting andof Stockholders or until his or her successor is duly elected and qualified. DirectorsAll of the nominees are currently serving as directors and have agreed to serve if elected.

The Company's Amended and Restated Bylaws provide for a majority vote standard in uncontested director elections. Under the Amended and Restated Bylaws, each director must receive a majority of the votes cast with respect to that director at the Annual Meeting. For this purpose, a "majority of the votes cast" means the number of votes cast "for" a nominee must exceed the number of votes cast "against" such nominee. If an incumbent director does not receive a majority of the votes cast, the director must promptly tender his or her offer of resignation to the Board for consideration. In such event, the Board may decrease the number of directors on the Board, fill any vacancy, refuse to accept such offer of resignation or take other appropriate action. The Amended and Restated Bylaws provide that directors will be elected by a plurality of the votes cast. Only votes cast for a nominee will be counted, except that the accompanying Proxy will be voted for the three nomineesin contested elections. The resignation policy set forth in the absence of instructionsCompany's Amended and Restated Bylaws does not apply to the contrary. Abstentions, Shares held of record by a broker or its nominee ("broker Shares") for which the brokerage firm has not received express voting instructions from the beneficial owner and instruction on the accompanying Proxy to withhold authority to vote for one or more of the nominees will result in the respective nominees receiving fewer votes than if the votes were cast for the respective nominees.contested elections.

For voting purposes, proxies requiring confirmation of the date of beneficial ownership received by the Board of Directors with such confirmation not completed so as to show which Shares beneficially owned by the shareholderstockholder are entitled to five votes will be voted with one vote for each Share. See "Voting by Proxy and Confirmation of Beneficial Ownership" beginning on page 52. In50.

Under the event any nomineeCompany's Statement of Corporate Governance Guidelines and Principles, each director is unable to serve (an event management does not anticipate), the Proxy will be voted for a substitute nominee selected by the Board of Directors or the number of directors will be reduced.

In 2014, the Board of Directors approved a recommendation by the Governance Committee to adopt an eighteen year term limitation for directors in addition to the existing policy that requires a directorrequired to submit his or her resignation upon a change in employment or significant change in responsibilities and at the Annual Meetingannual meeting of stockholders following the earlier of the date when he or she reaches age 72. The new term limitation applies72 or has completed 18 years of service on the Board. Mr. Growcock has attained the age of 72 and is expected to all directors without any grandfathering of current directors. If elected as a directorsubmit his resignation from the Board at the 2015 annual meeting, Mrs. WebertAnnual Meeting. Mr. Sala will reachcomplete 18 years of service on the new term limitationBoard in 2017. Therefore, Mrs. Webert2020 and is not expected to serve the full three-year term for which shehe is standingnominated for election at the 2015 annual meeting.Annual Meeting.

If for any reason any director nominee is unable to stand for reelection, the proxy holders will vote your Shares for the election of the other director nominees and the Board will designate a substitute nominee or reduce the number of directors. If a substitute nominee is designated by the Board, the proxy holders intend to vote your Shares for the substitute nominee.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEThe Board unanimously recommends that you vote "FOR" EACH OF THE FOLLOWING NOMINEES.the election of each of the three nominees listed below.

Unless a proxy is marked to give a different direction, the persons named in the proxy will vote"FOR" the election of each of the three nominees listed below.

A. Business Experience of Directors

Nominees for ElectionDirectors

The following table sets forth certain information relating to each director nominee, as furnished to the Company by the nominee. Except as otherwise indicated, each nominee has had the same principal occupation or employment during the past five years. All of the nominees are currently serving as directors and have agreed to serve if elected. However, as described above, Mrs. Webert is not expected to serve the full three-year term for which she is standing for election due to the eighteen year term limitation for directors approved in 2014.

Name | Age | and Other Directorships | Period of Service as a Director and Expiration of Term | |||

|---|---|---|---|---|---|---|

| James D. Frias | Executive Vice President, Treasurer and Chief Financial Officer (since January 2010) and Corporate Controller (from 2001 through 2009) of Nucor Corporation, a manufacturer of steel and steel products for North America and international markets. | February 2015 to date. Term expires | ||||

Corrine D. Ricard | 54 | Senior Vice President of Commercial (since February 2017), Senior Vice President of Human Resources (from April 2012 to December 2016), Vice President of International Distribution (from March 2011 to April 2012), Vice President of Business Development (from March 2007 to March 2011) and Vice President of Supply Chain (from October 2004 to March 2007) of The Mosaic Company, a leading global producer and marketer of concentrated phosphate and potash. Prior to Mosaic, Ms. Ricard worked for Cargill in various roles, including supply chain, product management and international sales. | February 2016 to date. Term expires 2018. | |||

Lawrence A. Sala | President and Chief Executive Officer of Anaren, Inc. (since September 1997), a manufacturer of microwave electronic components and subsystems for satellite and defense electronics and telecommunications. Former director | September 2002 to date. Term expires | ||||

Continuing Directors with Unexpired Terms

The following table sets forth certain information relating to each continuing director, whose term has not expired, as furnished to the Company by the director. Except as otherwise indicated, each director has had the same principal occupation or employment during the past five years.

Name | Age | and Other Directorships | Period of Service as and Expiration of | |||

|---|---|---|---|---|---|---|

| Robin J. Adams | October 2009 to date. Term expires | |||||

Robert G. Bohn | Chairman (from January 2000 to February 2011) and President and Chief Executive Officer (from November 1997 to December 2010) of Oshkosh Truck Corporation, a manufacturer of specialty vehicles and bodies for access equipment, defense, fire and emergency and commercial uses. Director of Parker-Hannifin Corporation (since August 2010) and The Manitowoc Company, Inc. (since May 2014). Former director of Graco Inc. (from June 1999 to January 2008). | April 2008 to date. Term expires | ||||

Name | Age | and Other Directorships | Period of Service as and Expiration of | |||

|---|---|---|---|---|---|---|

| September 2016 to | ||||||

D. Christian Koch | 53 | President and Chief Executive Officer of the Company (since January 2016). Chief Operating Officer of the Company (from | January 2016 to date. Term expires | |||

Gregg A. Ostrander | Executive Chairman (from January 2008 to June 2010), Chairman, President and Chief Executive Officer (from April 2001 to January 2008) and President and Chief Executive Officer (from January 1994 to April 2001) of Michael Foods, Inc., a national leader in egg products, refrigerated potatoes and branded cheese for food service and retail markets, including chain | August 2008 to date. Term expires |

Name | Age | Positions with the Company, Principal Occupation and Other Directorships | Period of Service as a Director and Expiration of Term | |||

|---|---|---|---|---|---|---|

| David A. Roberts | Chairman of the Company (since December 2016). Executive Chairman of the Company (from January 2016 to December 2016) and Chairman and Chief Executive Officer | June 2007 to date. Term expires | ||||

Jesse G. Singh | 52 | Chief Executive Officer of The AZEK Company (since June 2016), a leading manufacturer of building products. Previously, Mr. Singh served in a number of capacities with 3M Corporation, a global diversified technology company, including Senior Vice President of Supply Chain Transformation (from March 2016 to May 2016), President of 3M Health Information Systems Division (from September 2015 to February 2016), Senior Vice President of Marketing and Sales (from January 2014 to August 2015), Vice President and General Manager Stationary and Office Supplies Division (from March 2012 to December 2013) and President of 3M Sumitomo (from November 2007 to February 2012). Prior to 3M, Mr. Singh spent several years in general management, marketing and account management positions for General Electric Company and Arthur Andersen. | December 2017 to date. Term expires 2020. |

B. Specific Experience and Skills of Directors

The Board of Directors has identified nine specific areas of experience or attributes that qualify a person to serve as a member of the Board in light of the Company's businesses and corporate structure. The following table shows the experience or attributes held by each nominee and continuing member of the Board of Directors. The narrative discussion that follows the table describes the specific

experience, qualifications, attributes and skills of each nominee and continuing member of the Board of Directors.

| | Notable Multi- Industry Experience | Significant Experience in Company Specific Industries* | Experience as Chair/ CEO of Multi- National Business | Experience as CFO of Multi- National Business | Meets Definition of "Audit Committee Financial Expert" | Experience with International Business Issues | Mergers & Acquisitions Expertise | Experience | Corporate Governance Experience | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mr. Adams | ü | ü | ü | ü | ü | ü | ||||||||||||||||

| Mr. Bohn | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||

| ü | ü | ü | ü | ü | ||||||||||||||||||

| Mr. Frias | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||

| Mr. | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||

| Mr. Ostrander | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||

| Ms. Ricard | ü | ü | ü | ü | ü | |||||||||||||||||

| Mr. Roberts | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||

| Mr. Sala | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||

| ü | ü | ü | ü | ü | ü | |||||||||||||||||

Mr. Adams has twenty-seven27 years of experience with multi-national manufacturing companies with multiple business segment operating structures. As the principal financial officer of publicly traded companies for nineteen19 years prior to his retirement in April 2013, Mr. Adams gained significant experience with large merger and acquisition transactions. In addition, Mr. Adams servedhas more than 12 years of experience as a memberdirector of the boarda number of directors of BorgWarner, Inc. for eight yearsother public companies and, as a result, is thoroughly familiar with the duties and responsibilities of the audit and compensation committees of public company boards of directors.

Mr. Bohn served as Chairman and Chief Executive Officer of Oshkosh Truck Corporation, a global manufacturer engaged in several businesses that are similar to the businesses conducted by the Company. In this position,these positions, Mr. Bohn has gained significant experience with merger and acquisition transactions, and the evaluation of manufacturing opportunities in several countries.countries and board governance and performance.

Mrs. Callahan retired from IBM after twenty-sevenMr. Collins currently serves as Vice President and Head of eCommerce for Mylan N.V., a leading global pharmaceutical company offering products in approximately 165 countries. Mr. Collins has more than 12 years of service. Atexperience in digital marketing and eCommerce with a range of international industrial companies. This experience provides significant value to the time of her retirement, she was a member ofBoard as the Worldwide Management Committee which was comprised of the top fifty executives at IBM. In her last three positions with IBM, Mrs. Callahan had global management responsibilities including general management direction for all small and medium business sales and marketing. She also held positions in finance and planning, including Corporate Director of Strategy Evaluations and Chief Financial Officer for one of the sales divisions, and supervised the manufacturing and development for the Financial Services Business Unit.Company continues to pursue its online growth strategies.

Mr. Frias has served as the principal financial officer for foureight years and has a total of more than twenty-four26 years of experience in treasury, finance and accounting positions with Nucor Corporation, one of the largest and most diversified steel and steel products companies in the world. In these positions, Mr. Frias has gained substantial experience with mergers and acquisitions, joint venture transactions, the development of new facilities and the commercialization of new technology.

Mr. Growcock has more than fourteenKoch brings to the Board experience in a number of critical areas, including operations, senior leadership, global sales and mergers and acquisitions. With over 10 years of experience as a member of public company boards of directors and developed significant expertise during his career with merger and acquisition transactions, global procurement, lean manufacturing, international sales and marketing, global human resources, distribution and safety.the Company, Mr. Growcock is a member of the National Association of Corporate Directors and has participated in several board service training sessions conducted by that organization.

Mr. GrowcockKoch is thoroughly familiar with global trade and served as a memberall of the Advisory CommitteeCompany's businesses and can provide insight on those businesses to the United States Trade Representative for Trade Policy and Negotiations from 2005 to 2010.Board.

Mr. Ostrander haspreviously served as the president, chief executive officer and chairman of Michael Foods, Inc., a major food service and retail food company that producedproduces products for food service

distributors, chain restaurants and chain restaurants.retail grocery and club stores. As the result of his service in those positions, Mr. Ostrander became thoroughly familiar with the food service industry, a significant business for the Company.industry. He also has significant experience negotiating corporate merger and acquisition transactions and has served on the boards of directors of multiple public companies and their audit and compensation committees.

Ms. Ricard leads the commercial team at The Mosaic Company, a leading global producer and marketer of concentrated phosphate and potash. Previously, she served as the senior vice president of human resources for Mosaic, and, prior to that role, she held various leadership positions since Mosaic's formation, including vice president of international sales and distribution, vice president of business development and vice president of supply chain. In these positions, she gained substantial experience with executive management, mergers and acquisitions, joint venture transactions, international commerce and supply chain management. Prior to Mosaic's formation, Ms. Ricard worked for Cargill in various roles, including supply chain, product management and international sales.

Mr. Roberts formerly served as the chief executive officer of Graco Inc., a company engaged in a global, multi-industry manufacturing business. Mr. Roberts' experience with Graco was a primary factor leading to his recruitment as the Chief Executive Officer of the Company and appointment as a member of the Board of Directors. The Board of Directors also believes that a representative of management should be a memberAs the current Chairman of the Board. As the currentBoard and former Chief Executive Officer of the Company, Mr. Roberts is familiarprovides the Board with alla vital understanding and appreciation of the Company's businesses and can provide insight on those businesses to the Board.business.

Mr. Sala is the President and Chief Executive Officer of Anaren, Inc., a leading provider of microelectronics and microwave components and assemblies for the wireless and space and defense electronic markets. Anaren Inc. has operations in the United States and China and generates approximately 50% of its sales outside the United States. Anaren Inc. has completed numerous acquisitions during Mr. Sala's tenure.

Mrs. WebertMr. Singh is Chief Executive Officer of The AZEK Company, a leader in the building products industry. Previously, he served in a variety of leadership and membersinternational roles at 3M Corporation, including Senior Vice President of her family have been shareholdersSupply Chain Transformation, President of 3M Health Information Systems Division, Senior Vice President of Marketing and Sales, Vice President and General Manager Stationary and Office Supplies Division, and President of 3M Sumitomo. Mr. Singh also spent several years in general management, marketing and account management positions for General Electric Company and Arthur Andersen. In these positions, Mr. Singh gained significant experience in the Company for thirty-nine years. Mrs. Webert is an investor in several other publicbuilding products industry, international operations and private companies, and she has significant board experience with non-profit entities, including Spring Street International School, Friday Harbor, Washington, Kent School, Kent, Connecticut and the Island Sunrise Foundation. Mrs. Webert's diverse experience gives added perspective to themanaging within a diversified manufacturing environment.

C. Meetings of the Board and Its CommitteesDirectors

During 2014,The Company is governed by the Board of Directors and its various committees. The Board and its committees have general oversight responsibility for the affairs of the Company held nine (9) meetingsCompany. In exercising its fiduciary duties, the Board represents and had three (3) standing Committees: (i)acts on behalf of the Company's stockholders. The Board has adopted written corporate governance guidelines and principles, known as the Statement of Corporate Governance Guidelines and Principles. The Board also has adopted a Business Code of Ethics, which applies to the Company's directors and executive officers, including the principal executive officer, principal financial officer and principal accounting officer. The Business Code of Ethics includes guidelines relating to the ethical handling of conflicts of interest, compliance with laws, accurate financial reporting and other related topics.

All of the Company's corporate governance materials, including the charters for the Audit (ii)Committee, the Compensation Committee and (iii)the Corporate Governance and Nominating. All incumbent directors attendedNominating Committee, as well as the Statement of Corporate Governance Guidelines and Principles and the Business Code of Ethics, are available on the Company's website at least 75%www.carlisle.com. These materials are also available in print without charge to any stockholder upon request by contacting the Company at Carlisle Companies Incorporated, 16430 North Scottsdale Road, Suite 400, Scottsdale, Arizona 85254, Attention: Secretary, or by telephone at (480) 781-5000. Any modifications to these corporate governance materials will be reflected, and the Company intends to post any amendments to, or waivers from, the Business Code of all meetingsEthics that apply to the Company's principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions and that relate to any element of the Business Code of Ethics enumerated in the SEC rules, on the Company's website atwww.carlisle.com. By referring to the Company's website,www.carlisle.com, or any portion thereof, the Company does not incorporate its website or its contents into this Proxy Statement.

The Board andrecognizes the committeesimportance of director independence. Under the NYSE rules, to be considered independent, the Board on which they served during 2014.

The Audit Committee hasmust affirmatively determine that a director does not have a direct or indirect material relationship with the sole authority to appointCompany. Moreover, a director will not be independent if, within the preceding three years: (i) the director was employed by the Company or received $100,000 per year in direct compensation from the Company, other than director and terminatecommittee fees and pension or other forms of deferred compensation for prior service; (ii) the engagement ofdirector was employed by or affiliated with the Company's independent registered public accounting firm. The functionsfirm; (iii) the director is part of an interlocking directorate in which an executive officer of the Audit Committee also include reviewingCompany serves on the arrangementscompensation committee of another company that employs the director; (iv) the director is an executive officer or employee of another company that makes payments to, or receives payments from, the Company for andproperty or services in an amount which, in any single fiscal year, exceeds the resultsgreater of $1 million or 2% of such other company's consolidated gross revenues; or (v) the director had an immediate family member in any of the auditors' examinationcategories in (i)—(iv).

The Board has determined that 10 of the Company's books12 directors who served as a director during fiscal 2017 are independent under these standards. The independent directors are as follows: Robin J. Adams, Robert G. Bohn, Jonathan R. Collins, James D. Frias, Terry D. Growcock, Gregg A. Ostrander, Corrine D. Ricard, Lawrence A. Sala, Jesse G. Singh and records, internal accounting control procedures,Magalen C. Webert (who retired from the activitiesBoard on April 26, 2017).

The Board has determined that David A. Roberts, the Company's Chairman, and recommendationsD. Christian Koch, the Company's President and Chief Executive Officer, are not independent due to past

employment (in the case of Mr. Roberts) or current employment (in the case of Mr. Koch) by the Company.

In addition, each of the Company's internal auditors,directors serving on the Audit, Compensation and Corporate Governance and Nominating Committees are independent under the standards of the NYSE.

The Company currently has separated the roles of Chairman of the Board and Chief Executive Officer. David A. Roberts, a retired executive officer, serves as the Non-Executive Chairman of the Board and D. Christian Koch serves as the Company's accounting policies, control systemsPresident and compliance activities and monitoringChief Executive Officer. The Company previously combined the funding and investment performanceroles of Chairman of the Company's defined benefit pension plan. During 2014,Board and Chief Executive Officer and, in the Audit Committee held six (6) meetings.

The Compensation Committee administersfuture, the Company's annual and long-term, stock based incentive programs and decides upon annual salary adjustments for various employeesBoard may determine in certain circumstances that it is in the best interests of the Company includingand its stockholders for the same person to hold the positions of Chairman of the Board and Chief Executive Officer. Mr. Koch, as the Company's executive officers. During 2014,Chief Executive Officer, is responsible for setting the Compensation Committee held three (3) meetings.strategic direction for the Company and providing the day-to-day leadership of the Company, while Mr. Roberts, as the Non-Executive Chairman of the Board, provides guidance to Mr. Koch and sets the agenda for Board meetings and presides over meetings of the Board.

The Board of Directors acknowledges that independent Board leadership is important, and, accordingly, the Company's Statement of Corporate Governance Guidelines and Principles provides that when the Company's Chief Executive Officer serves as Chairman of the Board or, as is currently the case, the Chairman is otherwise not considered independent, the independent directors shall elect a Lead Independent Director. The director then serving as Chair of the Corporate Governance and Nominating Committee (the "Governance Committee") develops and maintains the Company's corporate governance guidelines, leads the search for individuals qualified to become members of the Board and recommends such individuals for nomination by the Board to be presented for shareholder approval at the Company's annual meetings, reviews the Board's compensation and committee structure and recommends to the Board, for its approval, directors to serve as members of each committee, discusses succession planning and recommends a new chief executive officer if a vacancy occurs. During 2014, the Governance Committee held two (2) meetings.

D. Committee Chair Rotation Guideline

The Board of Directors has adopted a Committee Chair rotation guideline. Under the guideline, effective as of the date of each annual shareholders meeting, a Committee Chair will relinquish his or her chairmanship. The guideline will result in each Committee Chair typically serving for three years. The Board of Directors believes bringing new leadership to each of the committees every three years will enhance the effectiveness of the committees. In accordance with this guideline, Mr. Ostrander succeeded Mr. Bohn as Chair of the Compensation Committee at the 2014 Annual Meeting, and it is expected that Mrs. Callahan will succeed Mr. Growcock as Chair of the Governance Committee at the 2015 Annual Meeting.

E. Remuneration of Directors

Lead Director. Stephen P. Munnalso serves as the Lead Independent Director. He was appointedThe Lead Director effective June 25, 2007. The Company pays Mr. MunnIndependent Director's duties closely parallel the role of an annual retainer of $300,000 for his service as a memberindependent Chairman of the Board of Directors, to ensure an appropriate level of independent oversight for Board of Director decisions. Mr. Bohn, the current Chair of the Corporate Governance and asNominating Committee and Lead Director. Mr. Munn doesIndependent Director, has the following responsibilities: (i) chair all meetings of the Board of Directors at which the Chairman is not receive any other compensation or stock or option awards for his service.

Mr. Munn entered into a retirement agreement withpresent and all executive sessions of the Company in 2001, when he ceased serving asBoard of Directors; (ii) liaise between the Chief Executive Officer ofand the Company. Underindependent directors; (iii) consult with the retirement agreement, Mr. Munn became entitledChairman concerning (a) information to receive the following benefits from the Company when he retired on June 25, 2007: (i) continued medical insurance for Mr. Munn and his wife at the premium rates in effect from time-to-time for active employees; (ii) $450,000 in group term life insurance on Mr. Munn's life; and (iii) a supplemental pension benefit of $29,324 per month for the life of Mr. Munn and his wife.

Other Non-employee Directors. The Company paid an annual fee of $65,000be sent to each director (other than Mr. Munn and Mr. Roberts). The annual fee is determined by the Board of Directors. Each non-employee director may electDirectors, (b) meeting agendas and (c) meeting schedules to receiveensure appropriate time is provided for all agenda items; (iv) call meetings of independent directors as required; and (v) be available when appropriate for consultation, including stockholder communications. In addition, the annual fee in cash or in Shares (or any combination of cash and Shares). Directors do not receive meeting attendance fees.

The Company also paysLead Independent Director presides over an annual fee for service on the Board's Committees. Each memberexecutive session of the Audit Committee received an annual fee of $15,000. The annual fee paid to each member of the Compensation and Governance Committees was $7,500. The Chairman of the Audit Committee received an additional annual fee of $15,000. The Chairman of the Compensation and the Governance Committees received an additional annual fee of $10,000. Beginning in 2015, the Chairman of the Governance Committee will serve as the Lead Director.

In addition to the annual retainer and committee fees, each director (other than Mr. Munn and Mr. Roberts) is eligible to participate in the Nonemployee Director Equity Plan. The Nonemployee Director Equity Plan provides for the grant of stock options, stock appreciation rights, restricted shares or units or other stock-based awards to non-employee directors. The Board administers the Nonemployee Director Equity Plan and has the discretionary authority to make all award decisions under the Plan. At theindependent directors at every regularly scheduled meeting of the Board of Directors held on February 5, 2014, the Board of Directors awarded each eligible director an award of 1,369 restricted stock units having a value of approximately $100,000 based on the closing price of the Company's common stock on the award date. Under the current policy of the Board, each new director receives an award of restricted stock units having a value of $50,000. All restricted stock units awarded to eligible directors are fully vested and will be paid in Shares of Company common stock after the director ceases to serve as a member of the Board, or if earlier, upon a change in control of the Company.

In December 2014, the Governance Committee reviewed the compensation payable to non-employee directors and a market analysis reported by Towers Watson, an independent compensation consulting firm. The Governance Committee recommended, and the Board approved, the following changes with respect to non-employee director compensation effective January 1, 2015: (i) a

$5,000 increase in the annual fee to the market median of $70,000, (ii) an increase in the annual equity portion of each director's pay to $120,000 from the current $100,000 level and (iii) a $20,000 increase in the retainer for the Chair of the Governance Committee for the additional responsibilities associated with serving as Lead Director. There were no other changes to the fees paid for service on the Board's Committees.

The Company also maintains the Deferred Compensation Plan for Non-Employee Directors. Under the Deferred Compensation Plan, each non-employee director of the Company is entitled to defer up to 100% of the cash fees otherwise payable to him or her. Each participant can direct the "deemed investment" of his or her account among the different investment funds offered by the Company from time to time. The investment options include (i) a fixed rate fund and (ii) Share equivalent units. All amounts credited to a participant's account under the Deferred Compensation Plan are 100% vested and generally will be paid or commence to be paid after the participant terminates service as a director. At the participant's election, payments can be made in a lump sum or in quarterly installments. Payments under the Deferred Compensation Plan are made in cash from the Company's general assets.

The Board of Directors has adopted stock ownership guidelines for non-employee directors. The guidelines require each non-employee director to own Shares, restricted stock units and Share equivalent units under the Deferred Compensation Plan having a market value equal to $325,000 within five years of his or her becoming a director. The ownership level equals five times the current $65,000 annual cash retainer payable to directors. Once the required market value ownership level is achieved, no further purchases are required in the event the value of the Shares held by a director fall below the ownership level due solely to a decrease in the market value of the Shares. All of the directors owned as of December 31, 2014 the number of Shares, restricted stock units and Share equivalent units required by the ownership guidelines as amended. The ownership guidelines prohibit any director from using Shares as collateral for any purpose or engaging in short sales or hedging transactions involving Shares. The Board approved an increase in the director stock ownership guidelines to $420,000 effective January 1, 2015. The increased ownership level equals six times the $70,000 annual cash retainer payable to directors beginning in 2015.

The Company does not make payments (or have any outstanding commitments to make payments) to director legacy programs or similar charitable award programs.

The following table summarizes the compensation paid to Mr. Munn, the Lead Director, and each other non-employee director for his or her service to the Board and its committees during 2014.

Because Mr. Frias was appointed to the Board in February 2015, he did not receive any compensation in 2014.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards(3) | Total ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Robin J. Adams | $ | 102,500 | $ | 100,000 | $ | 0 | $ | 202,500 | |||||

Robert G. Bohn | $ | 85,000 | $ | 100,000 | $ | 0 | $ | 185,000 | |||||

Robin S. Callahan | $ | 87,500 | $ | 100,000 | $ | 0 | $ | 187,500 | |||||

Terry D. Growcock | $ | 90,000 | $ | 100,000 | $ | 0 | $ | 190,000 | |||||

Stephen P. Munn | $ | 300,000 | $ | 0 | $ | 0 | $ | 300,000 | |||||

Gregg A. Ostrander | $ | 92,500 | $ | 100,000 | $ | 0 | $ | 192,500 | |||||

Lawrence A. Sala | $ | 87,500 | $ | 100,000 | $ | 0 | $ | 187,500 | |||||

Magalen C. Webert | $ | 72,500 | $ | 100,000 | $ | 0 | $ | 172,500 | |||||

| | Grant Date | Option Exercise Price | Total Outstanding | ||||||

|---|---|---|---|---|---|---|---|---|---|

Mr. Sala | 02/08/06 | $ | 34.43 | 4,000 | |||||

| 02/07/07 | $ | 41.87 | 4,000 | ||||||

Total | 8,000 | ||||||||

Mrs. Webert | 02/08/06 | $ | 34.43 | 4,000 | |||||

| 02/07/07 | $ | 41.87 | 4,000 | ||||||

| 8,000 | |||||||||

Total | |||||||||

F. Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's executive officers and directors, and persons who beneficially own more than ten percent (10%) of the Company's equity securities, to file reports of security ownership and changes in such ownership with the Securities and Exchange Commission (the "SEC"). Executive officers, directors and greater than ten-percent

beneficial owners also are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely upon a review of copies of such forms and written representations from its executive officers and directors, the Company believes that all Section 16(a) filing requirements were complied with on a timely basis during and for 2014.

G. Corporate Governance Matters

Board Leadership Structure. Mr. Roberts, as Chairman, leads the Board of Directors. Mr. Roberts is also the Chief Executive Officer of the Company. The Board of Directors believes that having Mr. Roberts serve as both Chairmanthe existence of a Lead Independent Director, the scope of the Board of DirectorsLead Independent Director's responsibilities and Chief Executive Officer shows management and all others who may deal with the Company that Mr. Roberts has full discretionary power and authority to lead the Company.

The Board of Directors does not believe that having Mr. Roberts serve as both Chairman and Chief Executive Officer adversely affects the independenceregularly scheduled executive sessions of the Board. Currently,independent directors all support strong corporate governance principles and allow the Board to effectively fulfill its fiduciary responsibilities to stockholders.

In addition, all of the Company's directors (other than Mr. Roberts)Roberts, a retired executive officer, and Mr. Koch, the Chief Executive Officer) and each member of the Audit, Compensation and Corporate Governance and Nominating Committees meet the independence requirements of the New York Stock Exchange.Exchange (the "NYSE"). Therefore, independent directors directly oversee such critical matters as the integrity of the Company's financial statements, the compensation of executive management, the selection and evaluation of directors and the development and implementation of the Company's corporate governance policies and structures. In addition, the Compensation Committee conducts an annual performance review of Mr. RobertsKoch, and, based upon this review, approvesmakes recommendations for his compensation including(including base salary and annual incentive and equity compensation.compensation) for approval by the independent members of the Board.

The Board has three standing committees: (i) the Audit Committee, (ii) the Compensation Committee and (iii) the Corporate Governance and Nominating Committee. Committee members and committee chairs are appointed by the Board of Directors. The members of these committees are identified in the following table:

Director | Audit Committee | Compensation Committee | Corporate Governance and Nominating Committee | |||

|---|---|---|---|---|---|---|

Robin J. Adams | X | X | ||||

Robert G. Bohn | X | Chairman | ||||

Jonathan R. Collins | X | |||||

James D. Frias | Chairman | |||||

Terry D. Growcock | Chairman | X | ||||

D. Christian Koch | ||||||

Gregg A. Ostrander | X | X | ||||

Corrine D. Ricard | X | X | ||||

David A. Roberts | ||||||

Lawrence A. Sala | X | X | ||||

Jesse G. Singh | X | X |

The Board of Directors has also adopted a committee chair rotation guideline. Under the guideline, effective as of the date of each annual meeting of stockholders, a committee chair will relinquish his or her chairmanship. The guideline will result in each committee chair typically serving for three years. The Board of Directors believes bringing new leadership to each of the committees every three years will enhance the effectiveness of the committees. In accordance with this guideline, Mr. Growcock succeeded Mr. Ostrander as Chair of the Compensation Committee at the 2017 Annual Meeting of Stockholders. At the Annual Meeting, Mr. Adams will succeed Mr. Growcock (who is expected to submit his resignation from the Board at the Annual Meeting) as Chair of the Compensation Committee.

Each committee of the Board of Directors functions pursuant to a written charter adopted by the Board. Set forth below is a summary of the principal functions of each committee.

Audit Committee. The Audit Committee has the sole authority to appoint and terminate the engagement of the Company's independent registered public accounting firm. The functions of the Audit Committee also include reviewing the arrangements for and the results of the independent registered public accounting firm's examination of the Company's books and records, internal accounting control procedures, the activities and recommendations of the Company's internal auditors, and the Company's accounting policies, control systems and compliance activities and monitoring the funding and investment performance of the Company's defined benefit pension plan. During fiscal 2017, the Audit Committee held seven meetings.

Compensation Committee. The Compensation Committee administers the Company's annual and long-term, stock-based incentive programs and decides upon annual salary adjustments for various employees of the Company, including the Company's executive officers. During fiscal 2017, the Compensation Committee held four meetings.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee develops and maintains the Company's corporate governance guidelines and principles, leads the search for individuals qualified to become members of the Board and recommends such individuals for nomination by the Board to be presented for stockholder approval at the Company's

annual meetings, reviews the Board's compensation and committee structure and recommends to the Board, for its approval, directors to serve as members of each committee, discusses succession planning and recommends a new chief executive officer if a vacancy occurs. During fiscal 2017, the Corporate Governance and Nominating Committee held two meetings.

The Board may also establish other committees from time to time as it deems necessary.

F. Director Meeting Attendance

The Board of Directors acknowledges that independent Board leadership is important, and for this reason, the Board has appointed a Lead Director, whose duties closely parallel the role of an independent Chairmanheld 10 meetings during fiscal 2017. Each incumbent director attended 75% or more of the Boardaggregate number of Directors, to ensure an appropriate level of independent oversight for Board of Director decisions. Mr. Munn, the current Lead Director, has the following responsibilities: (i) chair all meetings of the Board of Directors at which the Chairman is not present and all executive sessionscommittees of the Board on which the director served during fiscal 2017. Directors are not required to attend the Company's annual meeting of Directors; (ii) liaise betweenstockholders. However, all 11 of the Chairman and independent directors; (iii) consult withCompany's directors in office at the Chairman concerning (a) information to be sent totime attended the 2017 Annual Meeting of Stockholders.

At the conclusion of each of the regularly scheduled Board of Directors, (b) meeting agendas, and (c) meeting schedules to ensure appropriate time is provided for all agenda items; (iv) call meetings, of independent directors as required; and (v) be available when appropriate for consultation, including shareholder communications. In addition, the independent directors meet in executive session without management. Mr. Bohn, as the Lead Independent Director, presides at every regularly scheduled meetingeach executive session.

G. Director Nomination Process

As more fully described in its Charter, the Corporate Governance and Nominating Committee assists the Board by identifying and evaluating individuals qualified to be directors and by recommending to the Board such individuals for nomination as members. Director nominees should possess the highest personal and professional integrity, ethics and values, and be committed to representing the long-term interests of the Company's stockholders. Nominees should also have outstanding business, financial, professional, academic or managerial backgrounds and experience. Each nominee must be willing to devote sufficient time to fulfill his or her duties, and should be committed to serve on the Board for an extended period of time. Prior to accepting an invitation to serve on another public company board, directors must advise the Corporate Governance and Nominating Committee, which will determine whether such service will create a conflict of interest and/or prevent the director from fulfilling his or her responsibilities to the Company.

Neither the Corporate Governance and Nominating Committee nor the Board has a specific policy with regard to the consideration of diversity in identifying director nominees. However, the Board values diversity and the Corporate Governance and Nominating Committee has consistently included diversity as a desired qualification when conducting searches for director nominees. The composition of the Board reflects its emphasis on diversity.

The Corporate Governance and Nominating Committee may, at its discretion, hire third parties to assist in the identification and evaluation of Directors. The Boarddirector nominees. All director nominees, including candidates appropriately recommended by stockholders, are evaluated in accordance with the process described above.

H. Stockholder Recommendations of Directors believes thatDirector Candidates

Stockholders may recommend director candidates to be considered for the existenceCompany's 2019 Annual Meeting of a Lead Director,Stockholders by submitting the scopecandidate's name in accordance with provisions of the Lead Director's responsibilitiesCompany's Restated Certificate of Incorporation, which require advance notice to the Company and certain other information. Written notice must be received by the Company's Secretary at Carlisle Companies Incorporated, 16430 North Scottsdale Road, Suite 400, Scottsdale, Arizona 85254 not less than 90 days prior to the first anniversary of the Annual Meeting. As a result, any director nominations submitted by a stockholder pursuant to the provisions of the Company's Restated Certificate of Incorporation must be received no later than February 1, 2019.

The notice must contain certain information about the nominee and the regularly scheduled executive sessionsstockholder submitting the nomination, as set forth in the Company's Restated Certificate of Incorporation, including (i) the name, address and qualifications of the independent directors all support strong corporate governance principlesstockholder submitting the nomination; (ii) the name, age, business address and, allowif known, residence address of each nominee proposed in such notice; (iii) the Board to effectively fulfill its fiduciary responsibilities to shareholders.

Mr. Munn, who currently servesprincipal occupation or employment of each such nominee; (iv) the number of shares of capital stock of the Company of which each such nominee is the "Beneficial Owner" (as defined in the Company's Restated Certificate of Incorporation); and (v) such other information as would be required by the Lead Director, will retire fromsecurities laws of the United States and the rules and regulations promulgated thereunder in respect of an individual nominated as a director of the Company and for whom proxies are solicited by the Board of Directors on the date of the 2015Company. The presiding officer or chairman of the 2019 Annual Meeting of Stockholders may refuse to accept any such nomination that is not in proper form or submitted in compliance with the procedures in the Company's Restated Certificate of Incorporation. A stockholder who is interested in recommending a director candidate should request a copy of the Company's Restated Certificate of Incorporation by writing to the Company's Secretary at Carlisle Companies Incorporated, 16430 North Scottsdale Road, Suite 400, Scottsdale, Arizona 85254.

I. Related Person Transactions

The Board has adopted a written policy concerning the review, approval and monitoring of transactions involving the Company and "related persons" (directors, director nominees and executive officers or their immediate family members, or stockholders owning 5% or greater of the Company's outstanding Shares). The policy covers any transaction exceeding $120,000 in which the related person has a direct or indirect material interest. Related person transactions must be approved by the Corporate Governance and Nominating Committee which will approve the transaction only if it determines that the transaction is in the best interest of the Company. In the course of its review and, if appropriate, approval of a related person transaction, the Corporate Governance and Nominating Committee considers the relevant facts and circumstances, including the material terms of the transaction, risks, benefits, costs, availability of other comparable services or products and, if applicable, the impact on a director's independence.